قبل القيام بأول تداول في فوركس. عليك ان تسأل نفسك عدة أسئلة

ما هي افضل شركات الفوركس؟ هذا هو السؤال الذي يجب أن تطرحه جيداً

ينتهي الأمر بأغلبية المبتدئين بدفع رسوم مرتفعة جداً مقابل خدمات غير متقنة لأحد شركات الفوركس التي تمتلك القدرة على وضع إعلانات بكثرة. المتداولين المحترفين يتعاملون مع التداول في فوركس بشكل جدي، كما هو الحال مع أي عمل تجاري. قم بكتابة المعيار المهم بالنسبة لك. حاول بناء عرض تخيلي من الفكرة عن افضل شركات الفوركس.

فى هذا الموضوع سوف نتناول موضوع فى غاية الاهمية وهو معرفة افضل 10 شركات

من حيث :

1- تراخيص الشركة

2- السحب والايداع

3- المصداقية

4- برامج التداول الخاص بها

من افضل شركات الفوركس شركة fxsol و شركة fxcm و هذه الشركات تعد من الشركات العريقة في مجال تداول العملات و لذلك يفضل التعامل مع احدي الشركتين لمضان حقوقك و ذلك لان الشركتين مرخصتين من جهات رقابية قوية .

شركه اف اكس سول من اعرق و اقوي و افضل شركات الفوركس الموجوده عالميا الحاصلة علي ترخيص NFA الامريكي و FSA البريطاني و تمكن العميل من المضاربة بالعملات و الاسهم الامريكية و النفط و المعادن بالاضافة الي السماح باستخدام الهيدج.

شركة اف اكس سي ام تعد من الشركات المعروفة في الفوركس و تمنح العميل الكثير من المزايا لتسهيل المضاربة منها الهيدج و التداول بالعملات و المعادن و النفط و رافعة مالية تصل الي 1:400

شركة أمانة كابيتال

شركة عربية حاصلة علي ترخيص من البنك المركزي اللبناني و الترخيص البريطاني FCA

رافعة مالية تصل حتي 1:400

امكانية التداول علي العملات و المعادن و النفط و الاسهم الامريكية

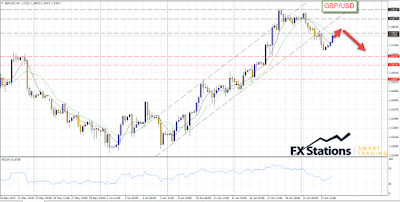

شركة اف اكس ستاشنز

شركة حاصلة علي ترخيص قوي نيوزلاند FSP

رافعة مالية تصل حتي 1:500

امكانية التداول علي الأسهم والسندات والسلع والعملات والمؤشرات

-سبريد قليل

-برامج التداول

FxS|Mobile,FxS|WEB,FxS|MT4 desktop

Social Trader

شركة أمانة كابيتال

شركة عربية حاصلة علي ترخيص من البنك المركزي اللبناني و الترخيص البريطاني FCA

رافعة مالية تصل حتي 1:400

امكانية التداول علي العملات و المعادن و النفط و الاسهم الامريكية

شركة Ikon Fx

شركة عملاقة في مجال الفوركس مرخصة بأستراليا ASIC و بريطانيا FCA

رافعة مالية تصل حتي 1:400

امكانية التداول علي العملات و المعادن و النفط و الاسهم الامريكية

شركة FXDD

شركة عملاقة مقرها مالطا حاصلة علي ترخيص MIFID و FCA

رافعة مالية تصل حتي 1:400

امكانية التداول علي العملات و المعادن و النفط و الاسهم الامريكية