dow Jones moved yesterday in the average movement of 195 pips, its highest level at 17713 and the lowest Level at 17522 and closed at 17672 to Gain 152 pips, during yesterday’s trading.

Dow opened today's trading at 17680 volatile between 17645 and 17682 during the Asian session trading at 37 pips for the poor liquidity in the market range, and in the European session the dow went up to 17712

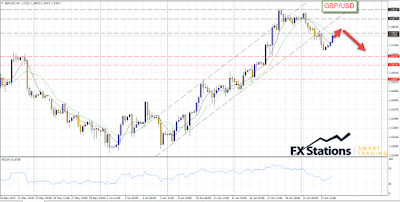

Dow moves in a series of up impulse waves after breaking the price channel.

It is expected that the oil is heading targeting 17750 to make a little of correction as the target on time frame of four hours and till now we see the Bulls control on market direction

And the Relative Strength Indicator "RSI" show us accumulation operations at the market

Today we could see sharp trading because of the economic data from USA

Support levels: 17558 and 17444 and 17367

Resistance levels: 17749 and 17826 and 17940

For More Technical Outlook FxStations

Dow opened today's trading at 17680 volatile between 17645 and 17682 during the Asian session trading at 37 pips for the poor liquidity in the market range, and in the European session the dow went up to 17712

Dow moves in a series of up impulse waves after breaking the price channel.

It is expected that the oil is heading targeting 17750 to make a little of correction as the target on time frame of four hours and till now we see the Bulls control on market direction

And the Relative Strength Indicator "RSI" show us accumulation operations at the market

Today we could see sharp trading because of the economic data from USA

Support levels: 17558 and 17444 and 17367

Resistance levels: 17749 and 17826 and 17940

For More Technical Outlook FxStations